tax fraud lawyer salary

The salary of most tax lawyers is often determined by billable hours. Tax Court Attorney Advisor.

Footballer Messi Misses Tax Fraud Trial Opening Expected To Testify On Thursday Lionel Messi Football Photography Lionel Messi Barcelona

Tax fraud lawyer salary Friday May 27 2022 Edit.

. The attorneys length of experience can move the figure. That could mean tax lawyers will have to keep track of every minute of work they do for clients. In early June the prestigious Manhattan law firm Cravath Swaine Moore announced it was raising the average salary for newly minted law graduates by nearly 13 to 180000 per.

State of Alabama Personnel Department 39. The average salary for a Fraud Officer is 57701. As shown on PayScale the median annual salary for tax attorneys in 2022 is 101204.

A minimum of 13 days a year. Tax fraud attorney Robert Barnes is thanked by Wesley Snipes following the not-guilty verdicts on all felony charges. For more information see the Office of Personnel.

In fact Richard Hatch the first winner of the television show Survivor was recently jailed for not paying federal taxes on his 1 million winnings. Heres a very simple breakdown of the average prices that tax attorneys charge for common tax services whether hourly or as a flat fee. The United States Bureau of Labor Statistics estimates the annual salary of a lawyer to be 120910.

With two to four years of experience the tax attorney salary ranges from 107996 to 146664 with an average salary of 135585. Search by income level experience and education. 15 years of federal service 26 days per year.

They may help clients navigate complex tax regulations so that clients pay the appropriate tax on items such as income profits and property. Candidates aspiring to be tax lawyers can rejoice from the fact that even the starting salaries of tax. Contact Robert Barnes directly at 213-318-0234 if youve been contacted by the IRS indicted arrested or convicted of tax fraud-related charges.

A valid Alabama driver license. Entry-Level Attorney Opportunities Salaries Benefits and Promotions. The national average salary for a Tax Lawyer is 44988 per year in United States.

100000 - 172649 a year. In fact many members of our leadership and executive teams first began their IRS career as a Tax Law Specialist. Starting salaries tend to be somewhere between 55000 and 83000.

Tax Attorney Salary. Average tax lawyers can expect to make slightly more than that amount. Entry-level tax attorney job salary ranges from 77735 to 105498.

Being in a career as a lawyer opens doors to various other career choices for students. Once you do a world of training and skills development will present itself to you as well as career progression and professional options. Taxes and tax fraud and healthcare.

Fraud real estate marital property bankruptcy tax liens. Lawyers who earned the high-end salary of 241870 for example would pay income tax of 45353 plus 33 percent of the amount over 186350 if filing singly according to Forbes. With four to seven years of experience the range is 148911 to 197523 with an average of 185967.

Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. Filter by location to see a Tax Lawyer salaries in your area. Attorneys earn vacation or annual leave based on the length of their Federal service 0-3 years of federal service 13 days per year.

By litigating these cases our lawyers play an essential role in developing federal tax law and in assuring the American public that everyone pays the tax they owe in accordance with the law. Salaries estimates are based on 3234 salaries submitted anonymously to Glassdoor by a Tax Lawyer employees. SIUFraud Attorney salaries in Plantation FL.

Lawyers who remain in the field of tax law can expect a steady increase in their annual earnings as their career progresses. Salaries for Tax Attorney Jobs. Ten 10 years of experience in conducting criminal tax fraudevasion investigations with a law enforcement or tax agency.

You may be fined or even jailed for tax fraud. Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. Ref 3 5.

The average salary for a Tax Attorney is 100143. Average salaries for US. The average Tax Attorney IV salary in the United States is 201141 as of April 26 2022 but the range typically falls between 173649 and 230465.

The salary of a tax attorney after years of education with a law degree is amongst the highest in the law profession. The average Criminal Lawyer salary is 96138 as of April 26 2022 but the salary range typically falls between 81707 and 114337. SENIOR SPECIAL AGENT-REVENUE TAX FRAUDEVASION.

Tax Law Specialists have. An entry-level position that opens possibilities. Tax lawyers handle a variety of tax-related issues for individuals and corporations.

You can enter the IRS as a Tax Law Specialist. Ben-Cohen is an Attorney-at-Law and a Certified Public Accountant CPA who specializes in civil and criminal tax controversy and litigation. Some states allow lawyers to take continuing education credits through.

Lawyers in Montana however with an average annual salary of 74130 would pay 5081 plus 25 percent of the amount over 36900 if filing singly. Ben-Cohen Law Firm PLC. Licensed for 18 years.

The average tax attorney CPA salary is 159500 dollars annually 13291 dollars monthly income weekly pay is. Insurance fraud includes workers compensation fraud unemployment tax and compensation fraud motor vehicle insurance fraud. According to a survey by Martindale-Avvo a legal marketing and directories firm tax attorneys charge 295 to 390 per hour on average.

Tax Court salary trends based on salaries posted anonymously by US. 3-15 years of service 20 days per year. A tax fraud attorney represents clients who the government claims have manipulated the system by paying too little tax or no tax at all.

51178 - 90310 a year. 1901 Avenue Of The Stars Ste 1100 Los Angeles CA.

Comparative Analysis Between Rera Consumer Protection Act Consumer Protection Legal Advisor Corporate Law

Federal Criminal Defense Lawyer Salary How Much Do They Make Federal Lawyer

Nysdtf Infographic National Tax Security Awareness Week Tax Help Infographic Awareness

Working In Uae Without Work Permit Is Illegal Dubai Human Resources Permit

Zombie Foreclosures In Florida On The Decline But Still High Foreclosure Lawyers Usattorneys Com Foreclosures Florida Outdoor Structures

How It Works Underwriting A Mortgage Payday Loans Loans For Bad Credit Debt Consolidation Loans

Civil Litigation Lawyers In Dubai Uae Litigation Lawyer Litigation Lawyer

Hartford Lawyer Convicted Of Felony Tax Fraud After Spending Lavishly On Himself Connecticut Law Tribune

Messi Best Images For Free Downalod Messi Barcelona Football Sports Lionelmessi Fotos De Messi Fotos De Lionel Messi Leonel Messi

Pin By Mzn On Messi In 2022 Messi Fictional Characters Character

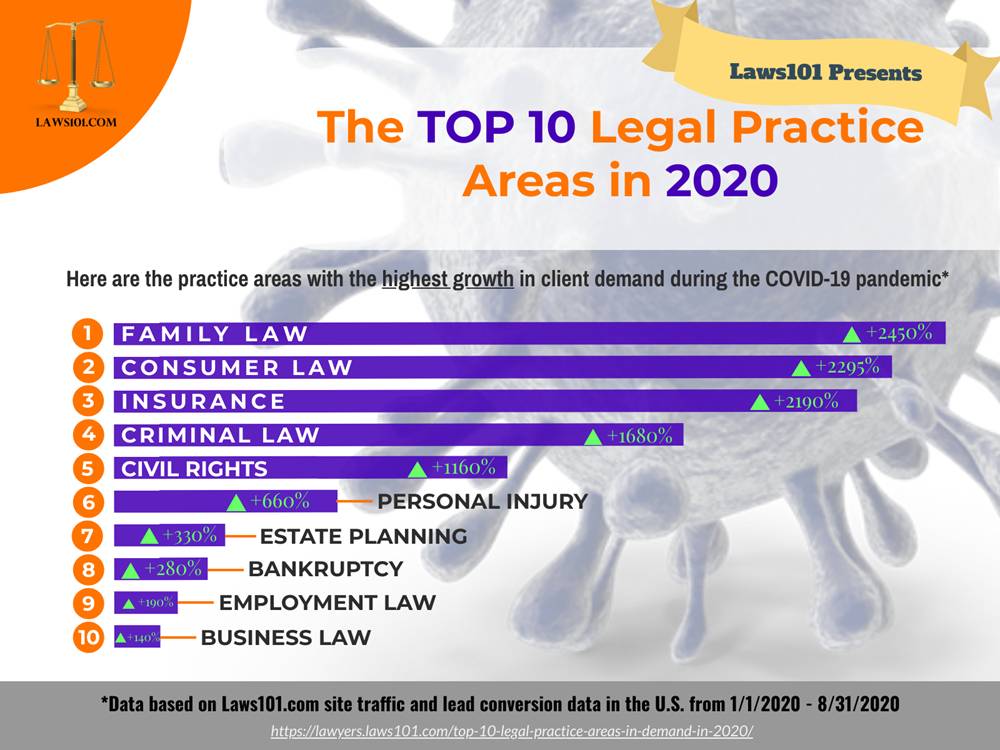

Top 10 Legal Practice Areas In Demand In 2020 Laws101 Com

Pin On Do The Work To Get The Work

How Much Does A Tax Attorney Cost Cross Law Group

Entry Level Corporate Lawyers Now Can Make 200k Or More

Top 5 Reasons You Should Outsource Payroll Payroll Outsourcing Workforce Management

Bankruptcy Exceptions To Discharge Jayweller Bankruptcy Bankruptcyexceptions Chapter13 Chapter7 Htt Filing Bankruptcy Bankruptcy Sell My House Fast

What Type Of Lawyer Makes The Most Money The Highest Paid Lawyers

Salary Of A Lawyer Litigation V Corporate Litigation Lawyer Litigation Lawyer