income tax rates 2022 south africa

R91 250 if you are younger than 65 years. The South Africa Income Tax Calculator is designed for Tax Resident Individuals who wish to calculate their salary and income tax deductions for the 2022 Tax Assessment year 1 March.

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

The amount above which income tax becomes payable is R141.

. 1216200 18 of taxable income 216201337800 38916 26 of. 33 Trusts other than special trusts 23 February 2022 N o changes from last year. 23 February 2022 No changes from last year.

Social Science Research Anol. 170734 39 of taxable income above. From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on.

If you have details on these tax tables and would like them added to the Africa Income Tax. Income Tax Rates and Thresholds. Foreign resident companies which earn income from a source in South Africa.

If you are 65 years of age to below 75 years the tax threshold ie. 115762 36 of taxable income above 488700. Barriers to up-scaling and relatively high rates of skill mismatch.

Taxable Income R Rate of Tax R 1 91 250 0 of taxable income 91 251 365 000 7 of taxable income above 91 250 365 001 550 000 19 163 21 of taxable income above 365. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. 2022 tax year is 1 March 2021 28 February 2022.

Regardless of whether they were South African citizens estate duty is applied to the assets of deceased people who lived in South Africa at the time of their passing. The budget proposes the adjust personal income tax brackets. Ad Compare Your 2023 Tax Bracket vs.

On 23 February 2022 the Minister of Finance announced that the corporate income tax rate would be reduced to 27 effective from years of assessment ending on or. Review the latest income tax rates thresholds and personal allowances in South Africa which are used to calculate salary after tax when factoring in social security contributions pension. Sage Income Tax Calculator.

South Africa Personal Income Tax Rate - 2022 Data - 2023 Forecast. Unfortunately we do not have the Tax Tables for 2022 entered into our Tax Calculator yet. The Personal Income Tax Rate in South Africa stands at 45 percent.

Personal Income Tax Rate in South Africa is expected to reach 4500 percent by the end of 2022 according to Trading Economics global macro models and analysts expectations. 7 rows South Africa Residents Income Tax Tables in 2022. Personal Income Tax Rate in South Africa averaged 4163 percent from 2004 until.

Calculate how tax changes will affect your pocket. As this fundamentals of south african income tax 2013 it ends in the works visceral one of the. Rates for 202 2 tax year 1 March 202128 February 2022 Individual income tax rate Taxable income ZAR Rate.

Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. 2023 tax year is 1 March 2022 28 February 2023.

Progressive tax rates apply for. Personal Income Tax Rate in South Africa averaged. Its so easy to.

Withholding Tax on Interest. 73726 31 of taxable income above 353100. The tax rate for the year 2022 in South Africa for companies is 27 until March 2023.

The same rates of tax are applicable to both residents and non-residents. In this section you will find a list of income tax rates. 2021 tax year is 1 March 2020 28 February 2021.

The tax years are. Your 2022 Tax Bracket To See Whats Been Adjusted. 8 rows Non-residents are taxed on their South African sourced income.

On 23 February 2022 South Africas Minister of Finance Mr Enoch Godongwana presented the 2022 Budget. The Personal Income Tax Rate in South Africa stands at 45 percent. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

Personal Income Tax Rate in South Africa averaged 4163 percent from 2004 until 2022 reaching an all time high of 45. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate.

Understanding The Budget Revenues

Taxation In New Zealand Wikipedia

How Much You Will Be Taxed In South Africa In 2022 Based On What You Earn

South Africa Personal Income Tax Rate 2022 Data 2023 Forecast

Business Tax Deadline In 2022 For Small Businesses

How Do Income Tax Brackets Work Jou Geld Solidariteit Wereld

Tax2601 Latest 2022 Graded A Plus Exams Nursing Docsity

Taxes Income Tax Tax Rates Tax Updates Business News Economy 2022

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

Personal Income Tax Has Untapped Potential In Poorer Countries

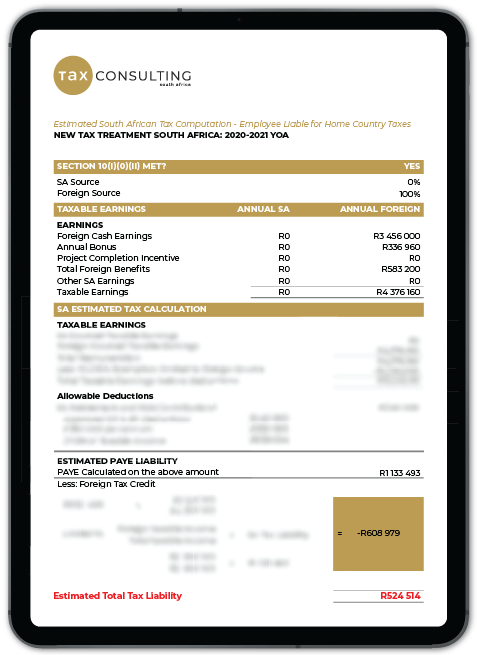

Tax Guide 2021 2022 Tax Consulting South Africa

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Global Minimum Tax An Easy Fix Kpmg Global

Winners And Losers From South Africa S Budget

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

South Africa S Highest Tax Rate Vs The Uk Dubai Hong Kong And New York

Budget 2022 23 Here Are Revised Tax Rates And Slabs For The Salaried Income Group Pakistan Business Recorder